MOA & AOA for Company Registration

Complete guide to Memorandum of Association (प्रबन्धपत्र) and Articles of Association (नियमावली) for company registration in Nepal. Expert document preparation and legal compliance.

Understanding MOA & AOA

Essential legal documents for company registration and governance in Nepal under the Patent, Design and Trademark Act, 1965

MOA (प्रबन्धपत्र)

A foundational legal document that defines your company’s constitution, objectives, powers, and scope of operations. The MOA serves as your company’s basic charter and is essential for company registration in Nepal.

- Company name and registered address

- Business objectives and scope

- Share capital structure

- Member liability (Limited/Unlimited)

- Association and Subscription clauses

- Authorized signatories

AOA (नियमावली)

Internal regulations and bylaws that govern how your company operates on a day-to-day basis. AOA details the rights, duties, and responsibilities of shareholders, directors, and company officers.

- Shareholder rights and obligations

- Director appointment and powers

- General meeting procedures

- Dividend distribution rules

- Accounting and audit procedures

- Amendment and dissolution processes

MOA vs AOA: Quick Comparison

Understanding the key differences between these two critical company documents

| Aspect | Memorandum of Association (MOA) | Articles of Association (AOA) |

|---|---|---|

| Purpose | Defines company’s external relations and constitution | Regulates internal management and operations |

| Scope | Broader – covers company’s fundamental structure | Narrower – covers internal governance rules |

| Key Focus | Objects, powers, and liability of members | Rights and duties of shareholders and directors |

| Applicability | Binding on company and all members | Binding on company and members in capacity as members |

| Amendment | Difficult – requires special process | Easier – requires ordinary special resolution |

| Third Parties | Affects third parties dealing with company | Generally doesn’t affect third parties |

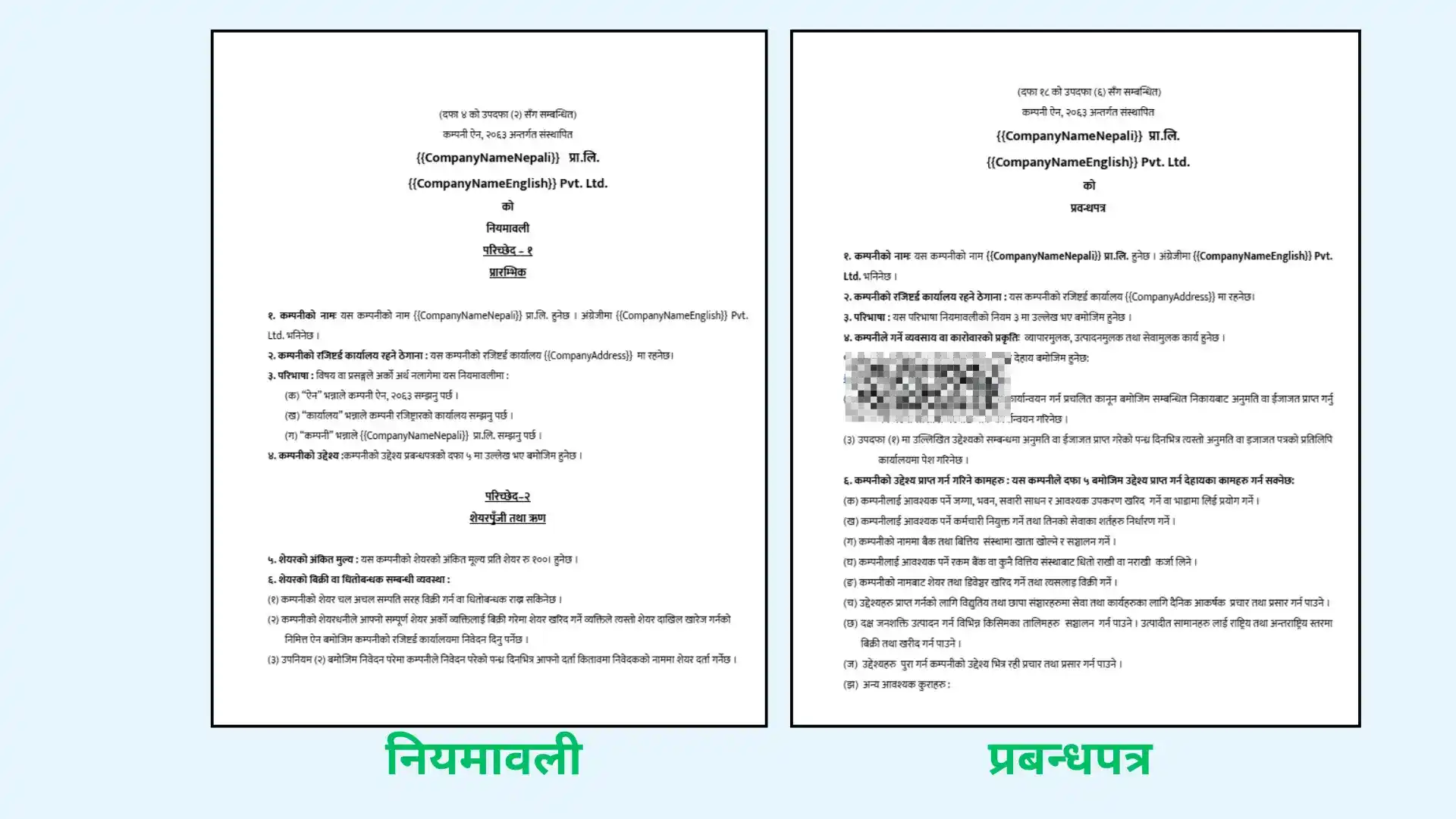

Real Examples of MOA & AOA Documents

See what properly formatted MOA and AOA documents look like in practice

What Should Be Included in Your MOA

Essential elements for proper company documentation and compliance in Nepal

Key Provisions in Articles of Association

Understanding the internal regulations that govern your company’s operations

Shareholder Governance

The AOA should clearly define the rights and obligations of shareholders, including voting rights, participation in meetings, and dividend entitlements. It should specify the classes of shares (if any), such as ordinary shares or preference shares, and any differential rights attached to each class. Provisions for share transfer restrictions, pre-emptive rights, and compulsory transfer mechanisms should also be included.

Board of Directors and Management

Your AOA must outline the composition of the board, qualifications of directors, appointment and removal procedures, and their powers and responsibilities. It should specify the number of directors, how they will be elected, their tenure, and any specific roles such as Chairman, Managing Director, or Chief Executive Officer. The process for holding board meetings, including frequency, notice requirements, and quorum, should be clearly articulated.

General Meetings and Voting

The AOA should establish procedures for holding general meetings of shareholders, including annual general meetings and extraordinary general meetings. It must specify notice periods, agenda setting procedures, quorum requirements, and voting mechanisms. Rules for remote participation, proxy voting, and postal ballots should be included to ensure flexibility and accessibility for shareholders.

Financial Management and Accounts

Provisions regarding accounting procedures, financial year, preparation of annual accounts, and audit requirements must be detailed. The AOA should specify how financial statements will be prepared, the timeframe for presenting them to shareholders, dividend policies, and procedures for distribution of profits. Transparency and accountability in financial management are critical for company credibility.

Amendments and Dispute Resolution

The AOA should include a clear process for amending its provisions, typically requiring a special resolution from shareholders. It should also contain provisions for resolving disputes between shareholders, between shareholders and directors, and between the company and any party. Mechanisms such as arbitration, mediation, and conciliation can be incorporated to resolve conflicts efficiently.

✨ Pro Tip: Both MOA and AOA should be drafted with future growth and changes in mind. Flexible provisions allow your company to adapt to new circumstances without requiring frequent amendments.

Why Professional Expertise Matters

The importance of consulting professionals when drafting MOA and AOA for your company

Legal Compliance

Professional lawyers understand Nepal’s Patent, Design and Trademark Act, 1965, and all regulatory requirements. They ensure your documents comply with all applicable laws and regulations, preventing future legal disputes and compliance issues.

Comprehensive Coverage

Experts ensure all necessary clauses and provisions are included in your MOA and AOA. A comprehensive document prevents legal disputes, avoids gaps that could be exploited, and protects all stakeholders’ interests.

Business Strategy Alignment

Professionals provide valuable guidance on shareholding structures, board composition, dividend policies, and governance matters. They help align your documents with your long-term business strategy and growth objectives.

Risk Mitigation

Well-drafted documents protect all stakeholders and minimize potential disputes. Professional review identifies potential risks, ambiguities, and loopholes, ensuring your company operates smoothly and transparently.

Time & Cost Efficiency

Professional preparation saves you time and money by getting everything right the first time. This avoids costly amendments, revisions, and potential legal complications that arise from poorly drafted documents.

Future Flexibility

Professionals draft documents with future growth and changes in mind. They include flexible provisions that allow your company to adapt to new circumstances without requiring frequent amendments.

Frequently Asked Questions

Common questions about MOA and AOA for company registration in Nepal

What is the difference between MOA and AOA?

The MOA is the company’s constitution that defines its external relations, objects, powers, and liability of members. The AOA are internal regulations that govern how the company operates, including shareholder and director rights and responsibilities. The MOA is more fundamental and difficult to amend, while the AOA can be modified more easily.

Is it mandatory to register MOA and AOA in Nepal?

Yes, registration of both MOA and AOA is mandatory for company registration in Nepal under the Patent, Design and Trademark Act, 1965. The Department of Industries requires these documents as part of the company registration process. Without proper MOA and AOA, your company cannot be legally registered.

Can MOA and AOA be amended after company registration?

Yes, both documents can be amended, but the process differs. MOA amendments require a special resolution from shareholders and must comply with complex procedures. AOA amendments typically require a special resolution and are relatively easier. However, frequent amendments should be avoided, which is why professional drafting is crucial.

What is the cost of professional MOA and AOA preparation?

The cost varies depending on the complexity of your company structure, number of shareholders, and specific requirements. Professional preparation typically involves consultation fees, drafting costs, and review charges. While there’s an upfront cost, it’s a worthwhile investment to avoid costly legal disputes and amendments later.

How long does it take to prepare MOA and AOA?

Professional preparation typically takes 3-7 days depending on the complexity and responsiveness of clients in providing necessary information. The timeline includes initial consultation, gathering information, drafting, client review, revisions, and final approval. BizSewa ensures quick turnaround without compromising quality.

Do I need different AOA provisions for different types of companies?

Yes, different company types (Private Limited, Public Limited, Cooperative, etc.) may have different AOA requirements. Some provisions are mandatory for certain company types, while others are discretionary. Professional consultants tailor the documents based on your specific company type and requirements.

Get Expert MOA & AOA Preparation

Don’t risk your company’s foundation with incomplete or non-compliant documents. Let BizSewa’s expert consultants prepare comprehensive, legally sound MOA and AOA documents tailored to your business needs and fully compliant with Nepal’s regulations.