Tax Plate / VAT Plate (Kar Pati) in Nepal

A Tax Plate (Kar Pati) is an official signboard that identifies taxpayers based on their VAT registration status. It helps the government, customers, and other stakeholders recognize whether a taxpayer is:

- Registered for VAT,

- Dealing in goods or services exempt from VAT, or

- Simply registered under PAN.

The system ensures transparency in business transactions by classifying taxpayers according to the nature of their business and their tax obligations.

Types of Tax Plates

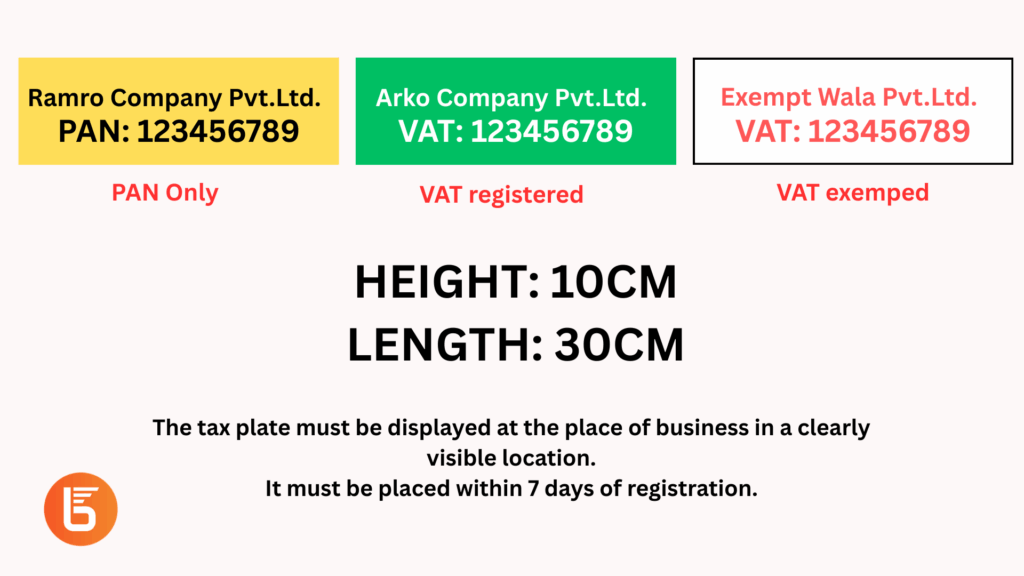

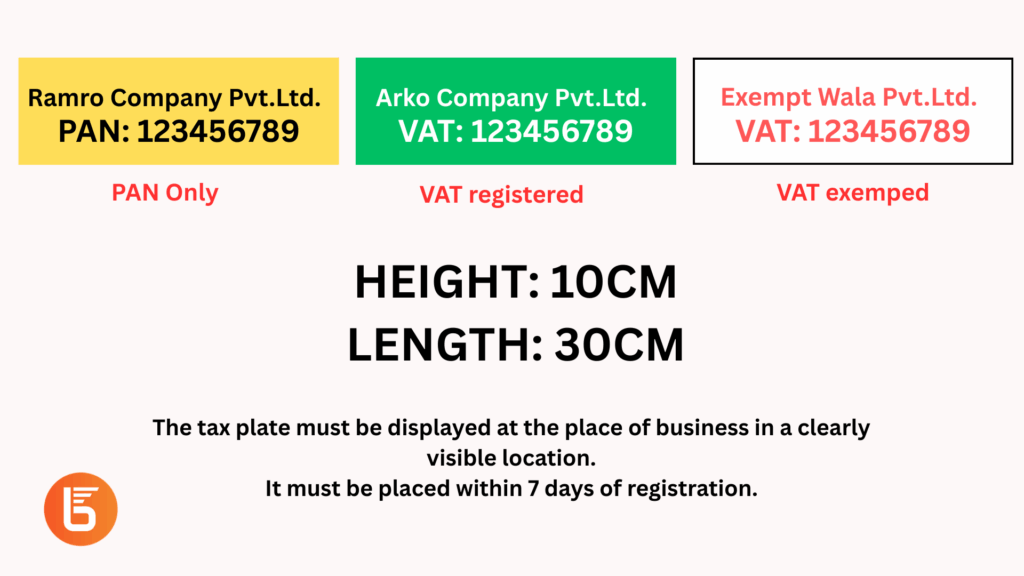

The color and design of the tax plate indicate the taxpayer’s category:

- VAT Registered → Green plate with white letters

- VAT Exempted (VAT Chut) → White plate with red letters

- PAN Registered → Yellow plate with black letters

Tax Plate Dimensions

Every tax plate must follow the prescribed size:

- Length: 30 cm

- Height: 10 cm

Placement of the Tax Plate

- The tax plate must be displayed at the place of business in a clearly visible location.

- It must be placed within 7 days of registration.

Penalty for Not Displaying the Tax Plate

If a taxpayer fails to keep the tax plate as per law and regulations, or does not display it at the designated place, a fine of Rs. 2,000 will be imposed under Section 29 Kha (1).

In summary: The Tax Plate (Kar Pati) is a mandatory identification tool that distinguishes taxpayers by their VAT/PAN status. Using color-coded plates makes it easy to recognize whether a business is VAT registered, exempt, or only under PAN. To avoid penalties, every taxpayer must display the plate in their business premises within 7 days of business registration.