Company Registration Process

in Nepal (Complete Guide)

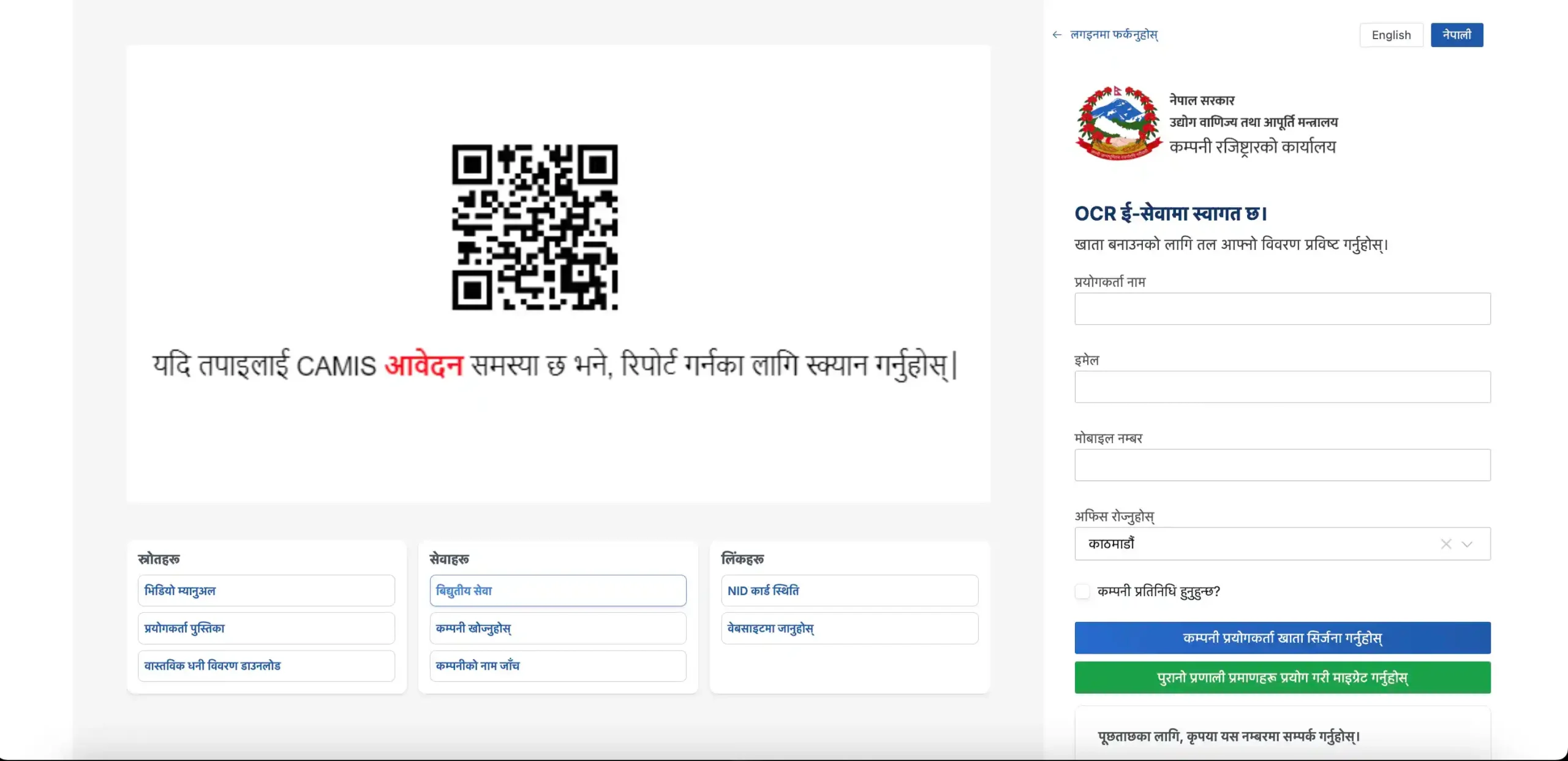

From Shrawan 2081, the OCR moved to the CAMIS digital system. This comprehensive guide covers fees, required documents, and the step-by-step procedure.

This guide provides complete and up-to-date information on company registration in Nepal(कम्पनी दर्ता), including legal procedures, required documents, timelines, and compliance obligations. Whether you are starting a new business or formalizing an existing one, this resource will help you understand the entire registration process under Nepalese law.

As per the Companies Act, the following types of companies can be registered in Nepal:

- Private Company

- Public Company

- Profit Not Distributing Company

In this guide, we will focus specifically on the registration of a Private Limited Company in Nepal.

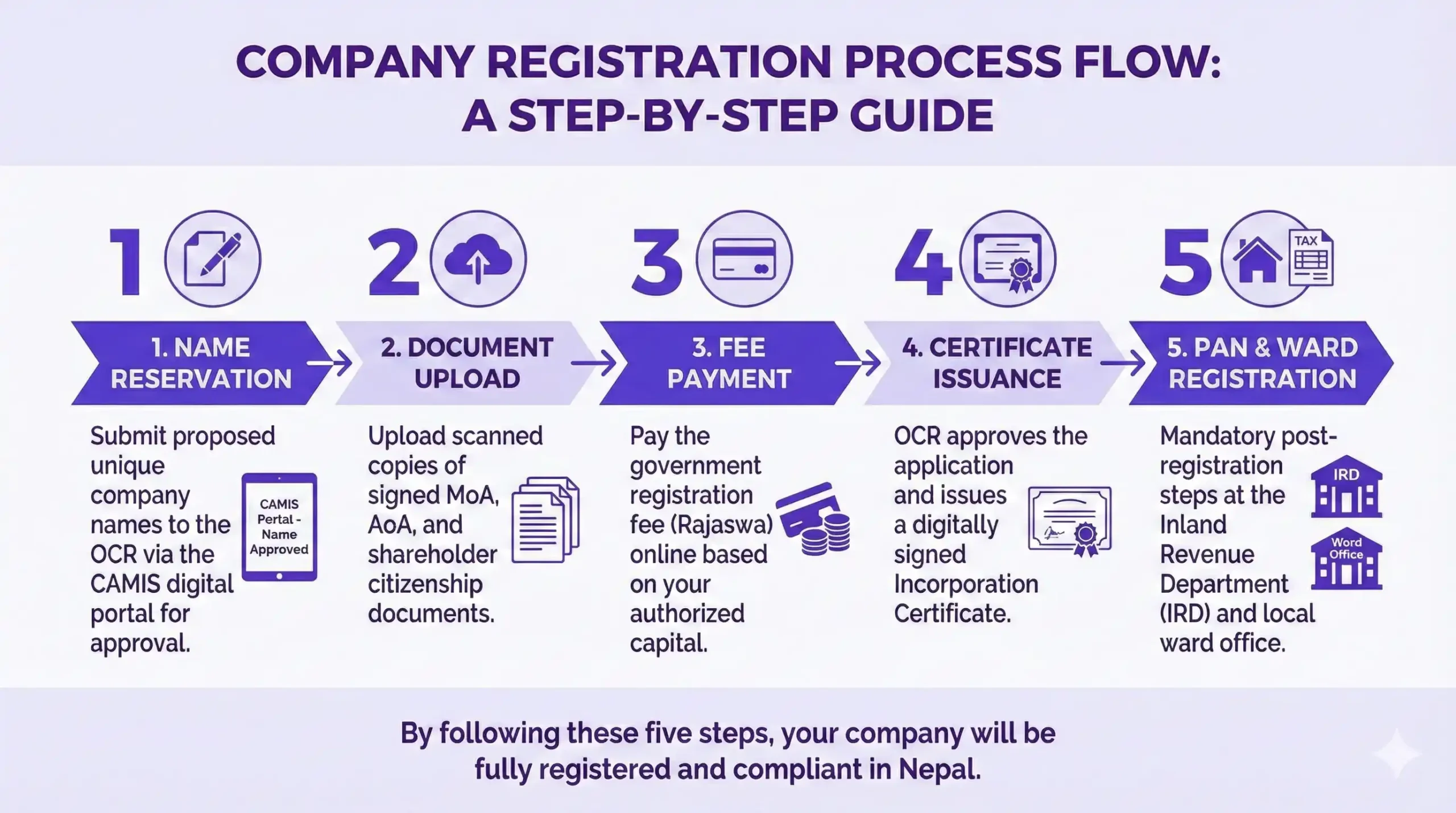

Step-by-Step Company Registration Process

Registering a company in Nepal is now fully digital via the CAMIS system. Follow these steps to ensure a smooth application.

Name Reservation & Account Setup

First, create an account on the Office of Company Registrar (OCR) portal using your email and mobile. Submit your proposed company name in both English and Nepali. You must also select the primary objectives of your business from the predefined list.

Document Preparation & Upload for OCR

Once your name is approved, you have 90 days to upload the required documents. Ensure these are scanned clearly:

- Memorandum of Association (MoA) & Articles of Association (AoA)

- Citizenship copies of all shareholders

- Application form with witness details

Payment of Revenue (Rajaswa)

After OCR officers review and approve your documents, you will receive a payment notice. You can pay the company registration fee pay the registration fee via digital wallets (eSewa/Khalti) or bank transfer directly through the portal.

Certificate Issuance

Upon successful payment, the system generates your Company Registration Certificate. This new certificate is digitally signed and contains a unique QR code for verification.

Tips for a Smooth Company Registration

Prepare in Advance

Have high-quality scans of all shareholder citizenships and photos ready.

Double-Check Details

Ensure spelling of names matches citizenship certificates exactly.

Monitor Portal

Log in regularly to check for comments from OCR officers.

Fees & Timeline (2081/82)

Estimate your government registration fees and total costs.

Fee Calculator

COST BREAKDOWN

| Authorized Capital Range (NRS) | Registration Fee (NRS) |

|---|---|

| Up to 100,000 | 1,000 |

| 100,001 to 500,000 | 4,500 |

| 500,001 to 2,500,000 | 9,500 |

| 2,500,001 to 1 Crore | 16,000 |

| 1 Crore to 2 Crore | 19,000 |

| 2 Crore to 3 Crore | 22,000 |

| 3 Crore to 4 Crore | 25,000 |

| Above 10 Crore | 43,000 + 3,000 per additional Crore |

Estimated Timeline

| Process Step | Expected Duration |

|---|---|

| Name Reservation | 1 – 3 Days |

| Document Preparation | 2 – 5 Days |

| Online Submission | 1 – 2 Days |

| OCR Review & Approval | 2 – 5 Days |

| Ward Registration | 1 – 3 Days |

| PAN/VAT Registration | 1 – 3 Days |

| Total Estimated Time | ~ 8 to 21 Days |

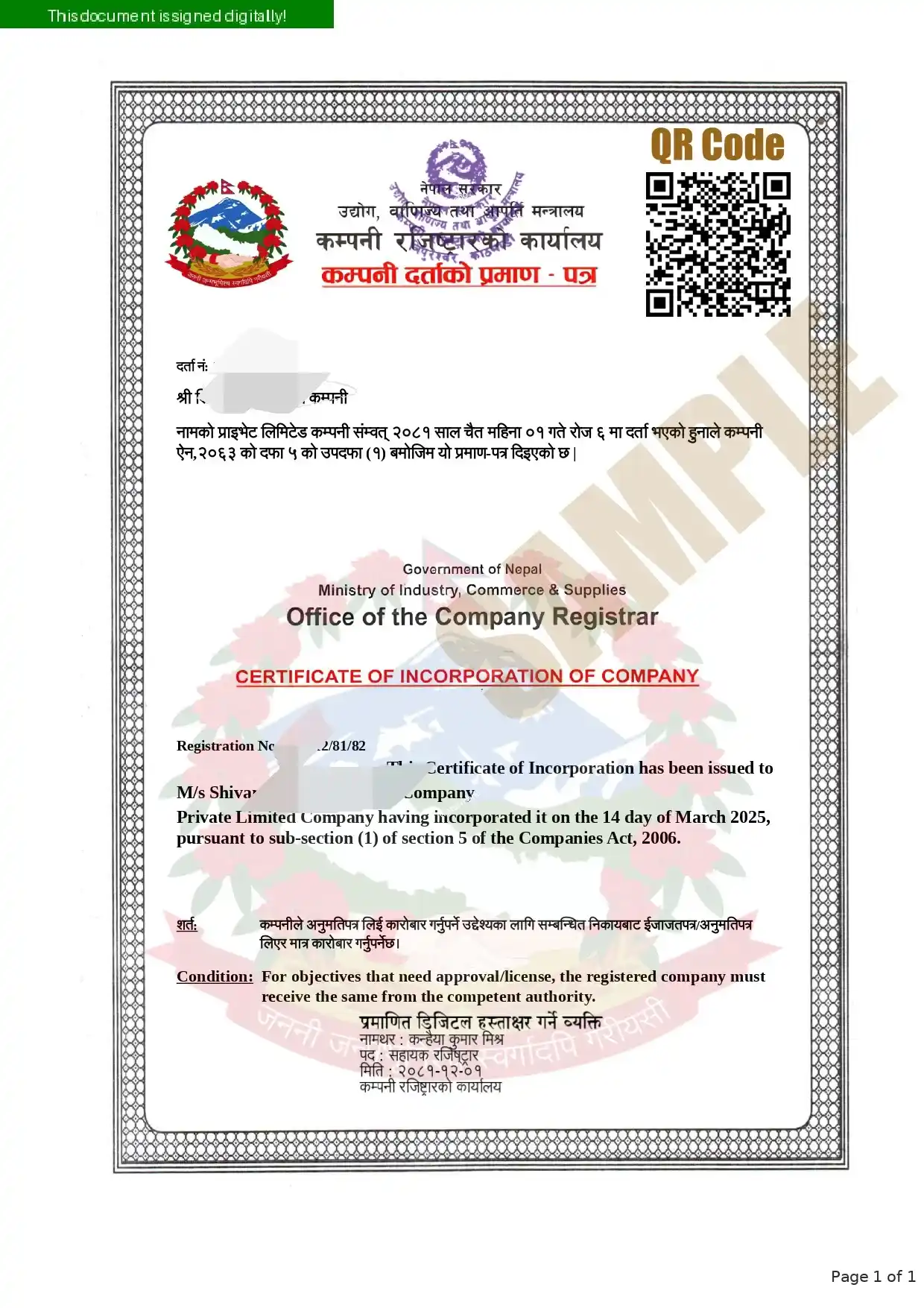

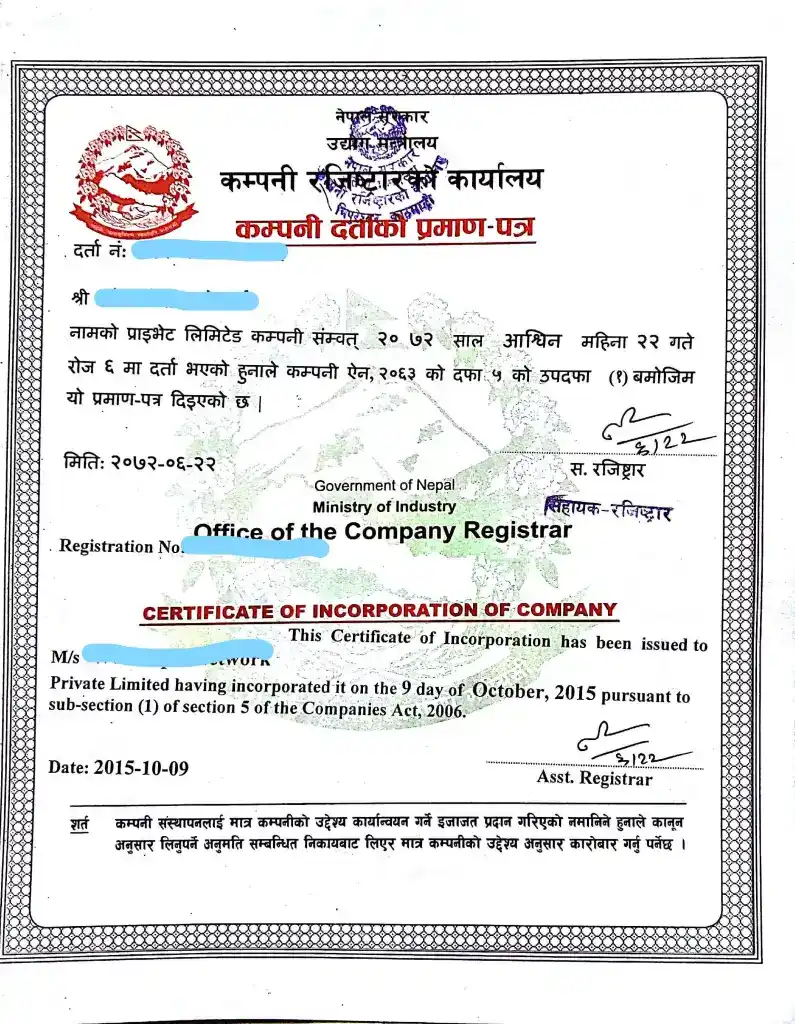

Registration Certificates

Digital vs. Manual Certificates.

New Digital Certificate

Includes QR code for instant verification. Downloaded directly from CAMIS.

Old Manual Certificate

Discontinued.

Post-Registration Compliance

Registration is just the beginning. Complete these mandatory steps.

Mandatory Annual Compliance

Every fiscal year (by Poush end), submit Audit Report and Annual Returns to avoid heavy fines.

Share Lagat

Prepare and certify the Share Lagat (Shareholder Register) after registration.

Resources & Downloads

Download Document Checklist

Get the complete PDF list of documents needed for PAN and Ward registration.

New CAMIS Portal

Related Services

Glossary & FAQ

Complete breakdown of terms and common questions.

Supreme legal document defining objectives and capital.

Defines internal rules for management.

Government body regulating companies.

Digital portal for registration.

Unique 9-digit tax ID.

13% consumption tax.

Official fee paid to government.

Record of share ownership.

A certificate stating the company is compliant until the date.

OCR CAMIS portal: Name reservation > Doc Upload > Payment > Certificate.

Visual Roadmap

A complete overview of the company registration roadmap in Nepal.

Ready to Start Your Business?

We handle the paperwork so you can focus on your vision. Get registered correctly from day one.