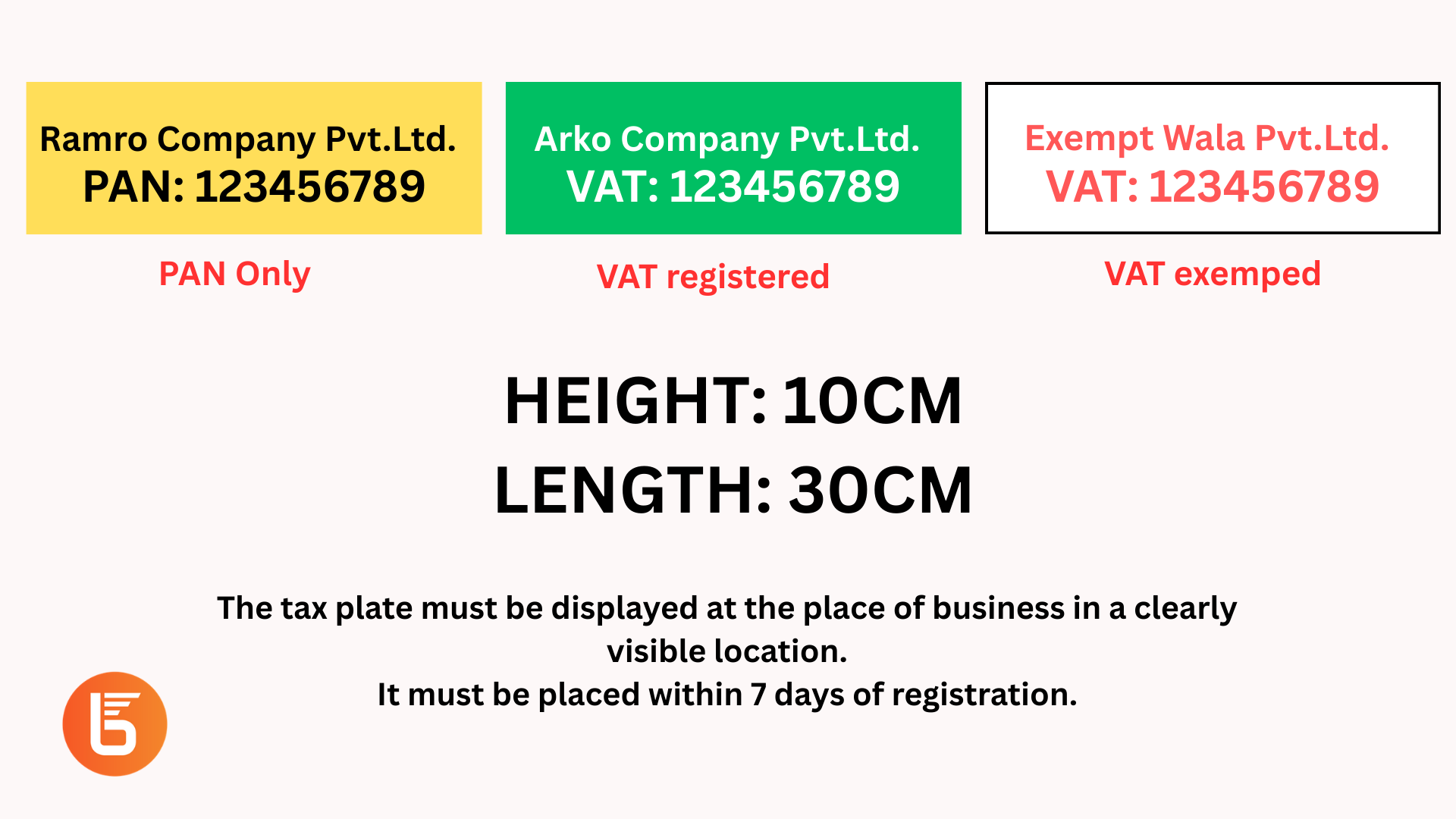

Different Invoice Types: PAN, VAT, Proforma and Estimated Bills

When running a business, whether you’re a small startup or an established enterprise, understanding the different types of invoices and receipts is crucial for proper financial management, tax compliance, and maintaining healthy business relationships. This comprehensive guide explains the key differences between PAN bills, VAT bills, proforma invoices, estimated bills, and cash receipts—essential documents every … Read more