The False Signal of Rise in the Nepal Stock Exchange

Overoptimism and overestimating can lead to a bubble, where prices tend to rise to unsustainable levels and eventually correct. Similarly, Misinformation or Manipulation in the market will lead to giving a false signal of a rise in the Stock Market Last but not the least, monetary policy from the government is more unexpected than the actual market scenario. Before some traders start to feel bad, let’s move to our discussion in depth with some fundamentals.

Recent HOR elections results and their impact to Share Market

After the election result, it is almost sure that the Nepali congress will make the government in Nepal with the ally’s party participated in the election. After the result came, things go the other way as the two allies Rashtriya Prajatantra Party and Nepal communist party (Maobadi) break the allies with congress and form a government with the communist party of KP Oli.

People started being over-sentimental and optimistic as PM Prachanda and Kp Oli government from the last time KP Oli government hugely benefited the market. But that’s not the case, the uncertainty of government still exists out there at the same time, and we can’t see any major development in economies.

The technical side

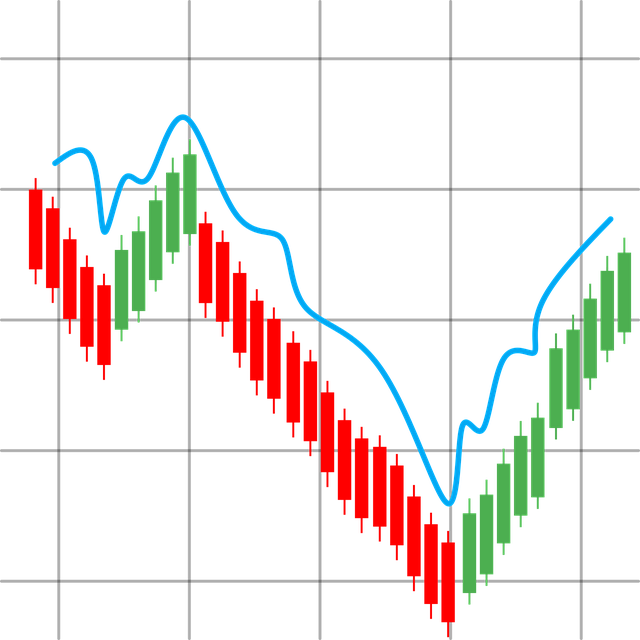

For me, the market is trying to test the previous supply range and after the test begins it will eventually fall is what expected. Well, another thing is volume, volume is not as high as it was during the previous bull. So, judging this aggressive rise of a bull is not a good estimation. Now, if that supply range is broken with volume and the trend line tends to rise we can say the market will rise. But for me, that’s not going to happen by checking other various factors.

- Supply range retest

- Volume is not confirmative

- Breakout needed to conclude the bull

- Test and fall are more likely to happen

The Fundamental Side

Fundamentally, all the listed companies in Nepal are not giving an overwhelming performance, Any company in the market is not operating at its best as it would be. The other is the economy is still reviving and we still depend on remittance and imports, and both are not good indicators for rising economies. Yes, there might be some cash with banks due to some restrictions but not enough to boost the economy like it used to before covid or even during it.

Companies’ fundamental ratios are not giving any clear indications for market rise or opportunity to invest. The global economy is still recovering and so do we. Still, we have a fear of economic crisis and loss of jobs in many sectors, so fundamentally we can’t see a clear indicator to invest.

FATF & Covid News

Lastly, recently published an article in the Kathmandu post that Nepal is in danger of getting gray-listed from FATF. We have witnessed the situation of Sri Lanka and Pakistan in recent days and the condition was not good. If anything like that happens there is not much we or our politicians can do.

Also, the new covid variant BF.7 is in the news and it may hit Nepal as well.

Good News

For primary market investors, there are 6 company upcoming IPOs in Nepal you can apply for using a Mero Share login. Also, the price cut news in oil and gas is something local citizens look for and it will be good for retail sectors as well. You can always earn some passive income especially if you are planning to move to a foreign country for work.

Conclusion

For me, it’s a false statement to judge a market as a bull with some aggressive increment in the trend line. It is still going to test the resistance line and once it breaks it we can then only decide. It’s still a bear market for me and if you are taking chances pls don’t do it with high volume. Research before you take any decision, this article is just for education, and we don’t want to hurt anybody’s intentions. Please give your view and feedback, we are always open to that.