Startup Loan in Nepal : Process, Eligibility, Quota, and Documents

Budget 2082/83 update: provisions for startup loan has been continued for the FY 2082/83. We will update specific details shortly.

Starting a business can be challenging, especially when it comes to financing. Many aspiring entrepreneurs in Nepal struggle to obtain funding for their business ideas. However, the Nepalese government has recognized the importance of startups and their potential for economic growth, leading them to launch a concessional loan scheme to support new businesses. In this blog post, we will discuss the criteria for eligibility for the startup loan, including the seven requirements set by the government, and explain the procedure for applying for the loan, including the necessary documents and where to submit them.

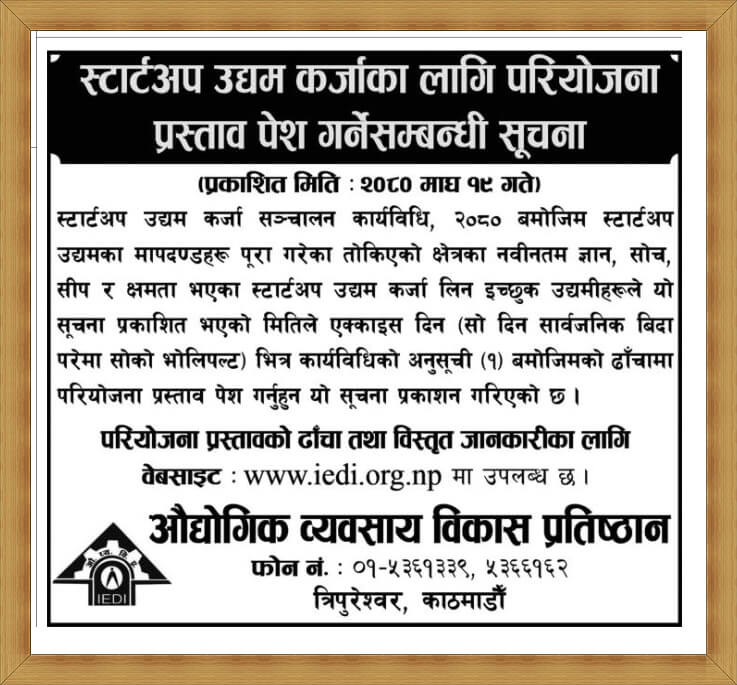

2024 Notice:

Startup Loan in Nepal at a Glance

- The Ministry of Industry, Commerce, and Supply has approved the Startup Enterprise Loan Fund Procedure 2079 in Nepal.

- Startups meeting government criteria can now get collateral-free loans up to Rs 25 lakh at a 3 percent interest rate for a maximum of 7 years.

- The government has allocated Rs 2.5 crore for such loans in the current financial year, benefiting 100 startup businesses.

- Startup enterprises operating for less than 7 years and meeting at least 5 out of 7 criteria set by the government are eligible for the concessional loan.

- The definition of startup includes enterprises in 14 types of sectors, such as science and technology, agriculture, education, infrastructure construction, etc.

- The loan facility aims to promote new and creative enterprises in Nepal.

- The lending bank will charge a loan service fee of 0.1 percent while disbursing the loan, and the loan principal can be repaid only after three years.

- The entrepreneurs who are allowed the loan need to come up with loan proposals to get the loan.

List of 7 criteria to be eligible for the startup loan

In order for a startup enterprise to qualify for a concessional loan in Nepal, it must meet a set of criteria established by the government. The enterprise must meet at least five out of seven specific criteria to be considered eligible for the loan.

- Paid-up capital should not exceed 50 lakhs rupees.

- Total income of the enterprise should not exceed 50 lakhs rupees per annum.

- Fixed capital (excluding fixed assets) should not exceed 20 lakhs rupees.

- The number of full-time employees in the enterprise should not be more than ten.

- At least two of the above four criteria must be met.

- The enterprise should use information technology and creative thinking to solve consumer problems in production or distribution.

- At least 5% of the total annual expenditure of the enterprise should be spent on product development, market development, and R&D. The enterprise must also have intellectual property, such as a patent or design or software registered.

At least five of these criteria must be met.

The following enterprises are not eligible to apply for the startup loan program

(a) Entity not registered in Nepal

(b) Importation of goods or services without the use of information technology and innovative thinking

(c) An existing company or business which has been demerged or operated as a subsidiary company or firm

(d) has been blacklisted in the tax information system or operated by such person

(e) has not obtained a permanent tax number (PAN)

(f) categorized as medium or large industry under the Industrial Business Act, 2076

(g) Prohibited by any prevailing law

(r) A company with a single shareholder

Procedure to apply for startup loan

To apply for a startup loan in Nepal, the applicant can email startup@doind.gov.np or visit the Department of Industry. The application must be accompanied by supportive documents such as the company registration certificate, PAN copy, tax filing, and the citizenship copy of the company’s official representative. All these documents should be sent in one file in PDF format. It’s important to note that only one loan can be applied for by a startup company.

Let’s discuss the startup loan in detail:

The Ministry of Industry, Commerce, and Supply in Nepal has approved and implemented the Startup Enterprise Loan Fund Procedure 2079, which enables startups to access loans at a concessional interest rate of 3% without the need for collateral. Startups that meet the government’s criteria can now obtain collateral-free loans of up to Rs 25 lakh at a 3% interest rate for a maximum of seven years. The government has allocated Rs 2.5 crore in the current financial year for these loans, benefiting up to 100 startups with a maximum loan limit of Rs 25 lakh each.

The loan application process will be opened to startups that meet the eligibility criteria laid down by the government. The entrepreneur will have to pledge the project for such loans, and the principal can only be repaid after three years. The bank will charge a loan service fee of 0.1% while disbursing such loans. The government’s allocated amount for the loan will be kept in a separate account by the national bank and will be transferred to the concerned bank account upon approval. If the lending bank receives a 3% interest rate on the loan, the principal must be returned to the national bank’s coffers.

The definition of startup includes enterprises in 14 types of sectors, such as science and technology, communication and information technology related to agriculture and livestock, forestry, tourism promotion and entertainment, hospitality, human health services, education and teaching learning, easy and safe transportation and transportation services, infrastructure construction, automobiles, traditional technology, improvement in the process of production and service delivery, mining and mineral research, and business start-ups related to development, household or daily living, food production and processing, and waste management and the environment.

To be eligible for the concessional loan, the startup enterprise must meet at least five of the seven criteria set by the government. The paid-up capital should not exceed 50 lakhs rupees, the total income of the enterprise should not exceed 50 lakhs rupees per annum, the fixed capital (excluding fixed assets) should not exceed 20 lakhs rupees, and the number of full-time employees in the enterprise should not be more than ten. At least two of these four criteria must be met. The enterprise should also use information technology and creative thinking to solve problems faced by consumers in the process of production or distribution of a product or service. Moreover, at least 5% of the total annual expenditure of the enterprise should be spent on product development, market development, and R&D. The enterprise must also have intellectual property, such as a patent or design or software, registered. At least five of these criteria must be met.

This initiative aims to promote new and innovative enterprises, and the Ministry plans to promote more creative startups in the future. The government’s support for startups is a significant boost to the country’s economy and entrepreneurship.

If you need any assistance in documentation for startup loan or any other type of finance, you can contact BizSewa at 9804495818. We help in business plan creation, financial planning, feasibility analysis and all.

[…] up to five years from the start of business. He also decided to provide a one percent interest rate soft loan to startup businesses to motivate the youth in […]

[…] via the family, by seeking a partner or by taking a personal loan. There is also the option of a startup business loan if you have collateral and a solid business […]

I need so hepl us

I need a loan for my startup ..I’ve a solid business idea with everything thing ready.. customer’s and dealer are ready .. everything is ready just I’m waiting for my startup once my start up start this business will grow up rapidly..

[…] to manage their loan portfolios and mitigate potential risks. By categorizing loans based on their credit quality and likelihood of repayment, institutions can make informed lending decisions and allocate […]

Startup loan

I need business loan plz give me a more information

I need some lone for business

I also need the loan to reinvest my business.How could I do apply for that pls.

I need a loan for my startup ..I’ve a solid knowledge with ready customer’s and dealer ..

I am working in the same field since 15 years.

everything is ready just I’m waiting for my startup once my start up start this business will grow up rapidly..

[…] to the startup loan procedure, businesses meeting certain criteria can apply for the loan. These criteria include having less […]

I have cow farm. I want take loan. It’s possible.

I need a loan for my startup ..I’ve a solid business idea with everything thing ready.. customer’s and dealer are ready .. everything is ready just I’m waiting for my startup once my start up start this business will grow up rapidly..

Sahakari

I want start oxygen Gas And lpg Gas Business. Can i apply for loan

Plz provide form for startup karja loan to fill up for getting loan iam poultry business man with sales ma boiler chicks pellet Dana and boiler khukhara supplies at various fresh house and i have 25 kisan

Hello sir ,i need loan amount 30lakh for agriculture form.i need to buy a tracter for plough.i can earn amount 2250000 from tracter in one year.i will return in 5 years.

Hello i need loan amount 3000000.

I am interested in this loan and also need these loan I am just started my gas business my family say go to abroad I want work on my on country so please reply my comments

Am I eligible for the loan?

I also want loan

I want loan for start my business how can i get

Business statup lon